Student financial aid is money provided to a student from a federal assistance program such as a Pell grant or nonfederal program like an institution grant that goes toward paying for their education in a college or trade school.

Financial aid is received by 85.5% of all students pursuing higher education including college, university, or career school, according to NCES.

There are two ways to classify financial aid. The first is need-based vs merit-based. Need-based financial aid considers the financial need of the student based on their or their household income, assets, family size and other financial factors. Merit-based financial aid is awarded based on superior performance in academics, athletics, the arts, leadership or other effort the university deems worthwhile.

The second way to classify financial aid is by type. The types include grants for financial need that do not need to be paid back and can be received as long as the student meets eligibility requirements, scholarships that remain in effect as long as the student meets the criteria, subsidized and unsubsidized loans and work-study programs that provide students with employment.

For need-based financial aid, some of the main factors determining eligibility and amount are the Expected Family Contribution (EFC), Cost of Attendance (COA), and enrollment status.

A student’s SAP or Satisfactory Academic Progress is an important factor in maintaining financial aid. The SAP shows whether the student is maintaining the minimum required GPA by the school and they are completing enough credit hours each semester to graduate in the required time.

What Is Financial Aid?

Financial aid is money for college or career school education. It is provided through a variety of assistance programs.

Most financial aid programs are federally funded. However, private student loans are offered by lenders too. Recipients of student financial aid include community college students, undergraduates and students in graduate studies. Students in career school, trade school and vocational school may also be eligible for financial aid.

The main types of student financial aid are grants, loans, work-study jobs and scholarships.

Financial aid can be used to cover tuition, fees, books, living expenses such as food, transportation and housing, both on-campus and off-campus housing, and related expenses.

What Is the Difference Between Need-based and Merit-based Financial Aid?

The difference between need-based and merit-based financial aid is the criteria used to award the aid.

Need-based financial aid is given to students based on the student’s financial need. Merit-based financial aid is awarded to students based on their academic success or achievements in related endeavors such as music or arts.

Need-based financial aid is federal student aid. The process begins with the student filling out the Free Application for Federal Student Aid, known as the FAFSA. Need based financial aid is based solely on a student’s financial status. Criteria include household income, assets, family size, and the number of family members in college at the time of applying.

Need-based federal financial aid programs include:

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- Direct Subsidized Loans

- Federal Work-Study (FWS) Employment

Merit-based financial aid is given to students based on specific achievements or talents. Examples include merit-based financial aid awarded for achievements in academics, athletics, music, arts and notable accomplishments. Aid is given in the form of grants, scholarships and financial awards.

Some students receive a combination of need-based financial aid and merit-based financial aid.

What Affects Eligibility for Financial Aid?

Several important factors affect a student’s eligibility to receive federal financial aid:

Expected Family Contribution (EFC): This is a key factor in need-based financial aid. EFC is determined after the FAFSA is completed. A student’s “EFC is calculated according to a formula established by law and considers your family’s taxed and untaxed income, assets, and benefits” like unemployment and Social Security.

Cost of attendance (COA): COA is the financial cost of going to school. It is calculated for 2-year and 4-year schools on the total cost for the school year. The Cost of Attendance is a calculation of the cost of tuition, fees, books and other course materials, housing, food, transportation and additional costs related to attending college.

Enrollment Status: Most federal student aid programs require students to be enrolled at least half-time. The amount of financial aid increases for three-quarter and full-time students.

How Many Years You’ve Been in School: Students can receive the Pell Grant for 12 semesters or roughly six years. This is known as LEU or the Pell Grant Lifetime Eligibility Used.

Enrollment in an Eligible Program: The student’s academic program can affect eligibility for some types of financial aid. For example, some programs are offered only to students in specific academic programs.

U.S. Citizenship or Legal Residency: Some forms of financial aid are only available to citizens and legal residents of the United States.

Satisfactory Academic Progress (SAP): To remain eligible for some forms of financial aid, students must meet GPA requirements while completing a minimum number of credit hours.

What Are Types of Financial Aid

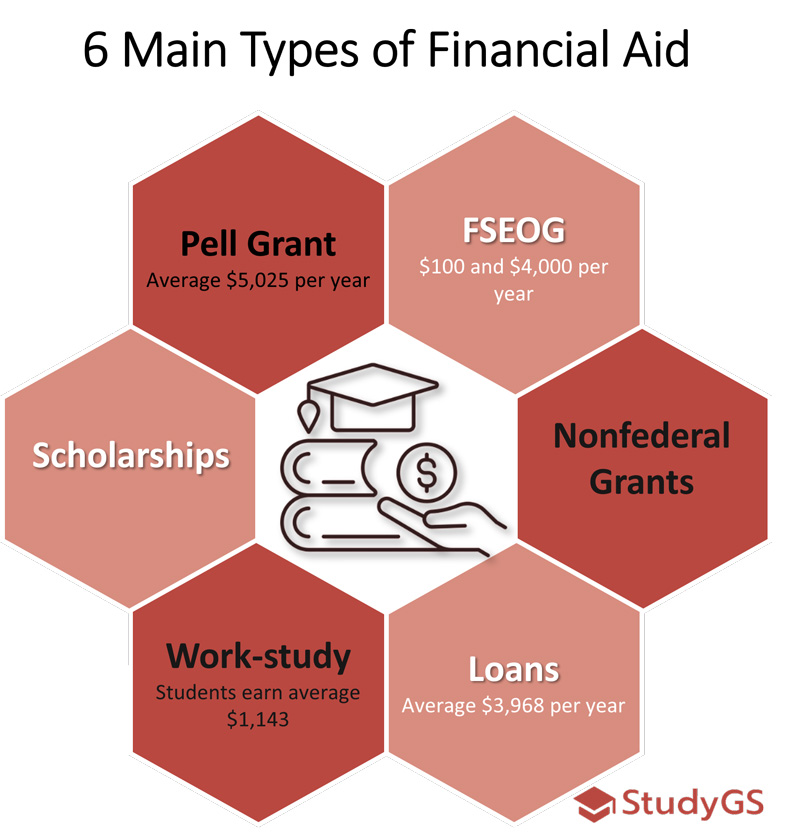

Types of financial aid include federal and non-federal aid. Here are the options students have when applying for financial aid.

- Pell Grant

- FSEOG or Federal Supplemental Educational Opportunity Grant

- Nonfederal Grants

- Scholarships

- Direct Subsidized or Unsubsidized Loan

- Federal work-study (FWS)

- TEACH or Teacher Education Assistance for College and Higher Education Grant

Pell Grants

Pell grants are federal grants for low-income undergraduate students pursuing education in a 2-year, 4-year or vocational trade school. Whether a student is eligible for this type of federal grant is determined by information they provide on the FAFSA about family income, other assets and the number of children pursuing higher education.

The Pell grant is the most popular type of financial aid, with 38.8% of students receiving this federal grant. The terms Pell grant and financial aid are used interchangeably when discussing need-based federal student aid. The maximum Pell grant amount for the current year is $7,395, and the average award in a recent year was $5,025, which includes half-time, three-quarters time and full-time students.

The disbursement schedule varies slightly from one institution to the next. However, most schools and universities disburse Pell grant monies shortly before the start of each school semester.

The US Department of Education has disbursement schedules that graph Cost of Attendance and Expected Family Contribution and show how much the Pell Grant will be based on those factors. There are Pell grant disbursement schedules for full-time, three-quarter time and half-time students.

FSEOG

FSEOG is a need-based federal grant given to students with the lowest EFC or Expected Family Contribution. The FSEOG grant is also referred to as the federal SEOG and stands for Federal Supplemental Educational Opportunity Grant. These federal grants are only available to students pursuing their first bachelor’s degree. Priority for the FSEOG is given to students that are also eligible for a Pell Grant. Current SEOG awards range from $100 to $4,000 and do not need to be repaid.

If you are eligible for a FSEOG award, it will be listed on your award offer after filling out the FAFSA. There is no separate application. Most schools disburse this federal grant automatically once the qualifying student is registered for classes.

Additional requirements include filing a FAFSA by March 1 and meeting income requirements as determined by the information provided on the student’s FAFSA. Unlike the Federal Pell Grant program that guarantees funds for each qualified student, there is a limited amount of money available to each school for SEOG awards. In these instances, “Funds are limited, and awards are not guaranteed from one year to the next.”

Nonfederal Grants

Nonfederal grants are grants for financial assistance to students or education expenses that are awarded by nongovernmental organizations. Criteria to be eligible for an award include financial need, academic achievement, specific talents in music, art or athletics, or a combination of these achievements.

Nonfederal grants include state grants, college and university grants, community grants, professional association grants, foundation grants and grants made by other private institutions.

Scholarships

Scholarships are usually awarded on the basis of a unique talent or achievement. They are given by educational institutions as well as private organizations. There are many categories of merit-based scholarships:

- Academic Scholarships: Criteria considered include high school GPA, scores on standardized tests like the ACT and SAT or superior proficiency in a subject such as math, science or foreign language.

- Athletic Scholarships: These scholarships are based on superior athletic ability in a men’s or women’s sport that the college or university participates in.

- Skills-based Scholarships: Schools award scholarships to students with exceptional talent in music, the arts, dance, cheerleading, theater, film, journalism and media, or writing.

- Leadership Scholarships: Students eligible for these scholarships show exceptional leadership impact within their communities through community service, implementing positive change or participating in extracurricular activities.

- First Generation Scholarships: Some institutions provide scholarships for students who are the first in their immediate families to attend college or university.

Work-study

The Federal Work-Study program or FWS provides part-time employment to students either on-campus or off-campus to allow the students to earn money for college expenses. Students are paid the federal minimum wage or higher, and the wages do not count as income on the next year’s FAFSA. Approximately 10% of full-time, first-year undergraduate students have FWS jobs, according to CCRC (Community College Research Center).

The most recent report by CollegeBoard shows that students earn in a federal work-study program an average of $1,143. FWS accounts for 10% of all federal aid that is not in the form of a grant or loan.

Loans

Student loans include subsidized and unsubsidized loans and loans that are federal and nonfederal. Here are student loan options and details.

- Direct Subsidized Loans: These need-based federal student loans range from $3,500 to $5,500 per year for first-year undergraduate students up to $5,500 to $7,500 per year for third-year students and beyond during the pursuit of a bachelor’s degree. These loans are only available to undergraduate students with financial aid. The total aggregate direct subsidized loan amount is $23,000.

- Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students, and there is no requirement to demonstrate financial need. Direct unsubsidized loans are available in amounts from $2,000 to $20,500 per year depending on how many years of college the student has completed plus whether they have dependents. Independent students qualify for higher direct unsubsidized loan amounts. The total aggregate amount of direct unsubsidized loans is $34,500 for undergraduate students and $73,000 for graduate students.

- Direct PLUS Loans: These loans are made to students and the parents of students that do not qualify for other types of financial aid. The Direct PLUS loans to graduate students are called Grad PLUS loans, and the Direct PLUS loans to parents of dependent undergraduates are called Parent PLUS loans. These loans are not need-based. A credit check is required, and those with a poor credit history must meet stricter requirements to secure a Direct PLUS loan.

- Direct Consolidation Loans: These loans are made to students and parents with other types of loans. A Direct Consolidation loan allows you to combine all federal loans into one with a single loan servicer.

- Nonfederal Loans: These are loans not funded or guaranteed by the U.S. government. Most nonfederal student loans are made by private financial institutions including banks and credit unions or by private individuals. Also called private student loans, these loans are classified as Other Student Loans by the National Center for Education Statistics to distinguish them from federal loans.

According to the Disgest of Education Statistics, federal loans are received by 37.5% of students while 5.3% receive nonfederal student loans, . The average amount of a federal loan is about $5,450 while the average nonfederal loan is about $14,000.

How Much Financial Aid Can You Get?

The amount of financial aid given to students ranges from an average of $1,288 to $11,726 per year, according to the report of NCES.

The amount of financial aid you can get depends on whether you qualify based on financial need and the types of student financial aid you pursue. Your enrollment status also affects how much financial aid you can get. Full-time students are eligible for more student aid than 3-quarter time and half-time students.

The average amount of financial aid is based on the programs the student qualifies for, both federal and nonfederal financial aid, according to the Summary Tables report from IPEDS.

- The average Pell Grant is $5,025 per year.

- The average Federal Grant is $4,719 per year.

- The average FSEOG Grant is between $100 and $4,000 per year.

- The average miscellaneous Federal Grant is $1,288 per year.

- The average State and Local Grants are $3,968 per year.

- The average Institutional Grant is $11,726 per year.

For students that need additional financial support, federal student loans and nonfederal student loans can be obtained from governmental and private sources.

How Credits Earned Per Semester Affect the Amount of Pell Grant You Can Get

Here is how credits earned per semester affects the amount of a Pell Grant received.

- 3 to 5 credits (part-time): 25% of the grant

- 6 to 8 credits (part-time): 50% of the grant

- 9 to 11 credits (part-time): 75% of the grant

- 12 or more credits (full-time): 100% of the grant

To receive at least 25% of a grant, students must earn at least 3 credit hours. Students earning 12 credits or more earn 100% of the grant.

How the Amount of Financial Aid Is Related to Family Income

For most income brackets from low-income to $110,000 or more, the higher the family income, the lower the financial aid total.

This table shows how family income is related to financial aid across all 4-year and 2-year institutions regardless of whether they are public or private.

| Family Income | All 4-year institutions | All 2 year institutions |

| $0 to $30,000 | 16,050 | 7,030 |

| $30,001 to $48,000 | 17,110 | 6,660 |

| $48,001 to $75,000 | 15,700 | 4,540 |

| $75,001 to $110,000 | 13,510 | 2,110 |

| $110,001 or more | 12,120 | 1,340 |

| Family Income | Public 4-year College | Non-profit 4-year College | For-profit 4-year Colleges |

| $0 to $30,000 | $12,300 | $28,110 | $7,310 |

| $30,001 to $48,000 | $11,830 | $31,320 | $7,920 |

| $48,001 to $75,000 | $8,900 | $29,940 | $6,900 |

| $75,001 to $110,000 | $5,080 | $26,570 | $5,970 |

| $110,001 or more | $3,060 | $22,370 | $7,000 |

How to Apply for Financial Aid

Applying for financial aid begins with filling out the Free Application for Federal Student Aid or FAFSA. The information provided on the federal FAFSA determines a student’s eligibility for all types of financial aid.

Here are the steps most students and parents take in applying for federal financial aid using the FAFSA:

- Have Documents and Information Available: These include the student’s Social Security number, driver’s license number if applicable, the Adjusted Gross Income from the most recent federal tax return, W-2 and 1099 forms, bank records, records of non-taxed income and other information regarding the student’s or student’s family’s assets.

- Create a Federal Student Aid Account and ID

- Complete the Online FAFSA: The FAFSA form is available on the federal government’s Student Aid website. The form requires the applicant or the applicant’s parents to disclose financial information. An IRS Data Retrieval Tool allows applicants to transfer tax information from the IRS onto the FAFSA. A FAFSA Help Page is also available with useful help topics.

- List Codes of Colleges and Universities the Student is Applying To: Information regarding federal financial aid will be sent directly to the schools you list.

- Review, Sign and Submit the FAFSA Application

- Receive the Student Aid Report (SAR): The SAR is not your financial aid offer. It includes the applicant’s basic information about your eligibility for federal student aid.

- Provide Additional Documentation, If Necessary: Schools may require additional documentation or have an additional financial aid application.

- Receive, Review and Accept Financial Aid Offers: When the student is accepted by schools on the list provided, each school will make financial aid offers. The offers include scholarships, grants, loans and work-study opportunities based on the student’s financial need. The student then accepts the financial aid package offered by the school of their choice.

There are FAFSA deadlines to consider. The earliest date to submit a FAFSA is October 1 of the year prior to starting college. The deadline for completing the FAFSA is June 30 of the year the student plans to begin school.

Students should “fill out the FAFSA form as soon as you can on or after Oct. 1” to ensure that they do not miss out on any financial aid opportunities.

The length of time it takes to get a financial aid award letter or offer depends on when the student files the FAFSA and when the school considers it. A student’s FAFSA information is available to schools one day after it is processed, “but each college has its own time frame for accessing FAFSA information.” Most schools extend financial aid package offers when sending out admissions letters.

Federal financial aid typically disburses around the start of each semester. If the school is on quarters, disbursements must be made at least twice per year.

How to Stay Eligible for Your Financial Aid

To stay eligible for financial aid, a student must maintain Satisfactory Academic Progress (SAP), which are academic standards related to acceptable grades and progress in earning credits. And the student must continue to meet the basic eligibility requirements that were met to obtain initial financial aid. There are no federally mandated eligibility requirements.

Every student receiving federal financial aid receives an SAP from the institution they are attending. The Satisfactory Academic Progress process shows whether the student meets the academic criteria required by the school to remain eligible for financial aid. Each school develops its own criteria for the SAP. But most schools use the following requirements or similar. As a student, you must:

- Maintain the GPA requirement for your school, which is typically 2.0. To stay eligible for some merit-based academic scholarships, a high GPA of 3.0 to 3.5 must be maintained.

- Maintain the required enrollment status such as half-time to full-time and earn enough credits to stay on pace to graduate in the required period of time.

- Complete the minimum number of classes without dropping or withdrawing from more classes than is allowed.

- Stay out of academic probation or academic suspension.

Meeting basic eligibility requirements includes reporting financial changes to determine whether you are still eligible for financial aid, avoiding defaulting on student loans and meeting any specific program requirements. Students must also renew their FAFSA each school year.

Does Failing a Class Affect Financial Aid?

Failing a class can result in the loss of financial aid. Each college and university has its own criteria, but these general guidelines apply at most schools.

Failing a class affects financial aid if it lowers your GPA below the minimum threshold for receiving the aid required by the school’s SAP guidelines.

Students may also have to meet the school’s pace of class completion requirements. For example, Oregon State University’s failed and incomplete classes guidelines states that if failing a class means that a student does, “not maintain an overall Pace of at least 67%, federal aid eligibility can be lost.”

Does Withdrawing from a Class Affect Financial Aid?

Yes, withdrawing from a class will potentially reduce the amount of financial aid a student receives. If the student chooses to drop a class, eligibility for financial aid will be recalculated if it changes the student’s enrollment status.

For example, if a student drops a class and as a result their enrollment status changes from full-time to three-quarters time, it will cause a reduction in the student’s financial aid.

If dropping a class means the student has less than half-time status, the student might no longer be eligible for financial aid.

How Many Credits Total Does Financial Aid Cover?

The total number of credits covered by financial aid ranges from 144 credits to 180 credits depending on how tuition is used to pay for credit hours.

Financial aid covers 144 credits at schools that have a pay per credit hour system for tuition. The way this is calculated is by considering 12 credits per semester full time. 12 credits times 2 semesters is 24 credits per year and 144 credits in 6 years.

Financial aid pays for up to 180 credit hours at schools with flat fee tuition options where the same amount of tuition pays for more credit hours. This is also called the 150% Rule and Maximum Time Frame at schools with flat fee tuition. Most 4-year degrees are 120 credits, and 150% of 120 is 180 credits.

At 2-year schools with flat fee tuition, financial aid covers up to 90 credits, which is 150% of the 60 credits needed for most 2-year degrees.

Does Financial Aid Cover Retaking a Class

Financial aid covers retaking a class at most colleges and universities. How many times retaking the class is covered by federal student aid varies by school.

For example, at many schools, the financial aid policy for repeating classes says that financial aid will cover retaking a class one additional time if the student failed the class – or if passed the class but they want to attempt to improve their grade. Once the student has completed a class twice and received a passing grade, financial aid is no longer available for that class.

At other schools, the repeating coursework guide states that a student failing a class two times can have the third and fourth times taking the class covered by financial aid.

Do Pell Grants Cover Summer and Winter Classes?

Pell grants typically cover part or all of the cost of summer or winter classes. Grant money is typically disbursed twice per year, and those disbursements cover fall and spring semesters.

A third disbursement can be made to students to help cover summer and winter classes. This is called the year-round Pell grant rule, and it allows students to receive up to 150% of their standard annual Pell grant amount in a single year. For example, if a student’s Pell grant award is $6,000 per year, they may be eligible to receive up to $9,000 in one year when taking summer semester classes.

To qualify for a third disbursement, the student must maintain their eligibility for a Pell grant and have at least half time enrollment status. Students that intend to take summer classes, for example at Ferris State University, “are encouraged to reserve some of their annual federal loan eligibility to use in the summer.”

What Happens to My Financial Aid If I Graduate Early?

Your financial aid for your last semester in college will be prorated if you graduate early. You will not receive the entire year’s Pell grant or other type of federal financial aid.

For example, if your annual Pell grant amount is $6,000 and covers two semesters, you will receive half of that, or $3,000, for your last semester before graduating.

Can You Apply Financial Aid to an Accelerated Bachelor’s Programs?

Yes, you can apply financial aid to most accelerated bachelor’s degree programs. Federal financial aid programs like the Pell Grant apply to students pursuing degrees in accelerated programs just as they do to non-accelerated degree programs.

Does Being a Part-time Student Affect Financial Aid?

Yes, being a part-time student affects financial aid. Federal student aid including Pell grants are prorated based on your enrollment status. Full-time students receive 100% of their financial aid. Students with three-quarter enrollment status receive 75% of their financial aid. And students with half-time enrollment status receive 50% of their financial aid.

Direct Subsidized and Direct Unsubsidized loans are not prorated based on enrollment status.

How Does College GPA Affect Scholarships?

Your college GPA can affect your scholarship in several ways. If the scholarship is based on academic achievement, you must maintain the minimum GPA required to keep the scholarship or avoid having it reduced.

If the scholarship is based on athletics or other non-academic pursuit, GPA will not affect your scholarship as long as you remain academically eligible.

Being placed on academic probation or being academically suspended can lead to a loss of a scholarship.

Does ACT Score Affect a College Scholarship?

Yes, your ACT score is a significant criteria used by many schools and organizations to determine whether a student qualifies for merit-based scholarships, and if so, how much the scholarship is worth. Minimum ACT score thresholds are often used to determine eligibility for scholarships based on academic achievement.

An increasing number of colleges and universities no longer consider standardized tests scores like the ACT when determining scholarship recipients. At those schools, your ACT score will not affect your college scholarship eligibility.

What Is a Financial Aid Refund?

A financial aid refund is financial aid money left over after your education expenses such as tuition and fees are met. For example, Northwestern University’s financial aid refunds policy states that, “If the amount of your financial aid or loans is greater than the amount billed to you by the University, you will have a credit balance on your student account.” And the credit will be paid to you in the form of a financial aid refund.

Financial aid refunds are usually paid out shortly after the start of the semester. For example, Grand Rapids Community College states that, “refunds for all types of financial aid will begin 30 days after the start of the semester.”

You have several options for using your financial aid refund. It is your money and can be spent on educational expenses or personal expenses. And “in some cases, with your permission, the school may give the leftover money to your child.”

If the financial aid is in the form of a loan, your options are to keep the leftover money and be responsible for repaying it with interest. Additionally, “you have up to 120 days to cancel a part of your unused federal student loan money” without being charged fees or interests.